The Different Types of Real Estate Investments and Which May Be Right for You

Real estate investing can take many forms, from buying and flipping properties to holding onto rental properties for passive income. Some of the most common types of real estate investments include residential properties, commercial properties, and industrial properties. Residential properties include single-family homes, apartments, and other types of housing that are occupied by individuals or families. Commercial properties include office buildings, retail spaces, and other types of properties that are used for business purposes. Industrial properties include warehouses and other types of properties used for manufacturing and storage.

When deciding which type of real estate investment is right for you, consider your financial goals and risk tolerance.

Residential properties may be a good option for those looking for a steady stream of rental income, while commercial properties may offer higher potential returns . Industrial properties tend to be the least volatile, but may also offer the lowest returns. It's important to thoroughly research and evaluate the local real estate market, as well as seek the advice of professionals, before making a decision.

1.0 Introduction to real estate investing

A. Definition of real estate investing : Real estate investing refers to the purchase, ownership, management, and sale of real estate properties for the purpose of generating a profit. Real estate properties can include residential properties (such as single-family homes, apartments, and townhomes), commercial properties (such as office buildings, retail spaces, and warehouses), and industrial properties (such as manufacturing and storage facilities). Real estate investors may purchase properties with the intention of holding onto them as a long-term investment, or they may buy and sell properties more quickly, known as flipping, as a way to generate profits. Real estate investing can be a lucrative way to build wealth, but it also carries risks and requires careful planning and management.

B. The benefits of investing in real estate : There are several benefits to investing in real estate, including the potential for financial returns and the potential to build wealth over the long term. Some specific benefits of real estate investing include:

- Potential for passive income: Rent from tenants can provide a steady stream of income for real estate investors, particularly if the property is well-maintained and in a desirable location.

- Potential for appreciation: Real estate can increase in value over time, particularly if it is located in an area that is experiencing economic growth or a shortage of available housing.

- Diversification: Adding real estate investments to a portfolio can help diversify assets and potentially reduce risk.

- Leverage: Real estate investors can often use leverage, such as borrowing money through a mortgage, to purchase properties and potentially increase returns.

- Potential tax benefits: Real estate investors may be able to take advantage of tax deductions for expenses related to their properties, such as mortgage interest and property taxes.

It's important to note that real estate investing carries risks, and it is not suitable for everyone. As with any investment, it is important to carefully evaluate the potential benefits and risks before making a decision.

2.0 Types of real estate investments

- Residential properties (e.g. single-family homes, apartments)

- Commercial properties (e.g. office buildings, retail spaces)

- Industrial properties (e.g. warehouses)

3.0 Factors to consider when investing in real estate

Location : Location is an important factor to consider when investing in real estate because it can have a significant impact on the value of a property and its potential for generating rental income or appreciation. Some specific reasons why location is important in real estate investing include:

- Desirability: Properties located in desirable areas, such as those with strong job markets, good schools, and a low crime rate, are often more valuable and may be more attractive to potential tenants or buyers.

- Supply and demand: The balance between the supply of available properties and the demand for them in a given location can affect the value of real estate. If there is a high demand for housing in an area and a limited supply of available properties, the value of those properties may increase.

- Economic conditions: Economic conditions in a given location, such as the strength of the job market and the overall health of the local economy, can have an impact on the value of real estate.

- Amenities: The availability of amenities, such as restaurants, shopping, and recreation, can also affect the desirability and value of a property.

By carefully evaluating the location of a potential real estate investment, investors can make more informed decisions and potentially increase the chances of success.

Potential rental income : Potential rental income is an important factor to consider when investing in real estate because it can help to determine the feasibility and potential profitability of a property as a rental. Some specific reasons why potential rental income is important include:

- Cash flow: The rental income from a property can provide a steady stream of cash flow for real estate investors, which can be used to cover expenses related to the property, such as mortgage payments, taxes, and maintenance.

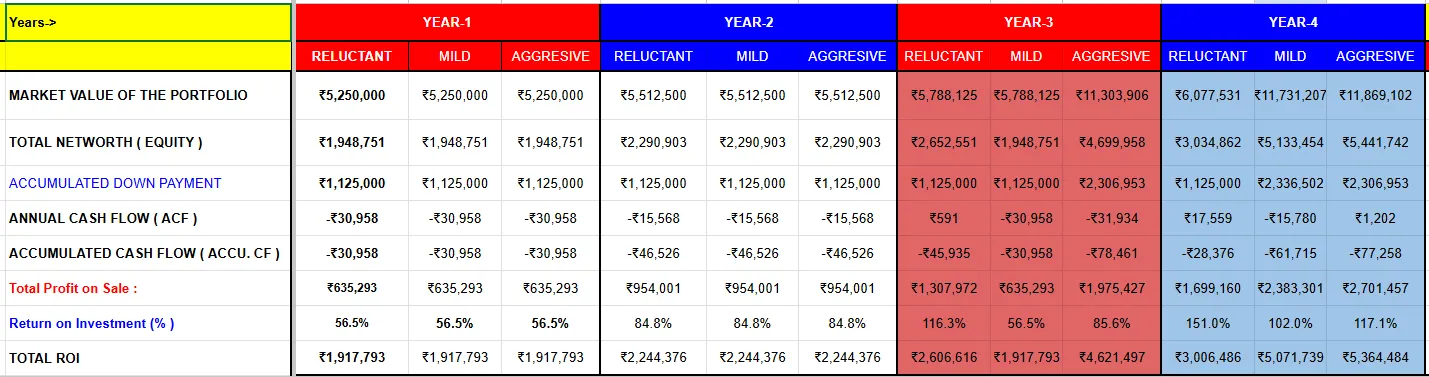

- Return on investment: The potential rental income from a property can be used to calculate the return on investment (ROI) for a real estate investment. A higher potential rental income can potentially result in a higher ROI.

- Feasibility: The potential rental income from a property can help investors determine whether a property is financially feasible as a rental. If the potential rental income is not sufficient to cover expenses, the property may not be a viable investment.

By carefully evaluating the potential rental income of a property, real estate investors can make more informed decisions and potentially increase their chances of success.

4.0 Strategies for finding and evaluating potential investments

- Researching the local real estate market

- Networking with real estate professionals

- Using online tools and resources (e.g. property listing websites, real estate data platforms)

5.0 Financing options for real estate investments

- Traditional mortgage loans

- Private mortgage loans

- Hard money loans

6.0 Managing a real estate investment

- Collecting rent and managing tenants

- Maintaining the property

- Maximizing the return on investment

7.0 Conclusion and tips for success in real estate investing

The importance of due diligence and careful planning:

Due diligence and careful planning are important for all real estate investments, but particularly in the Indian market, where there may be additional risks and challenges to consider. Some specific reasons why due diligence and careful planning are important when investing in Indian real estate include:

- Legal and regulatory considerations: India has a complex legal and regulatory environment for real estate, and it is important for investors to be familiar with these rules and how they may impact their investments. This can include issues such as land ownership, zoning laws, and building regulations.

- Market conditions: The Indian real estate market can be volatile and subject to significant price fluctuations. Careful planning and research can help investors make informed decisions and avoid potential pitfalls.

- Financing: Obtaining financing for real estate investments in India can be challenging, and investors should carefully consider their financing options and the potential risks and rewards of each.

By conducting thorough due diligence and carefully planning their investments, real estate investors in India can increase their chances of success and minimize potential risks.

The potential for financial returns and building wealth through real estate investing : Real estate investing has the potential to generate significant financial returns and help investors build wealth over the long term. In the Indian market, real estate investing can be particularly attractive due to the country's strong economic growth and the increasing demand for housing and commercial properties. Some specific ways that real estate investing can potentially lead to financial returns and wealth building in India include:

- Appreciation: Real estate values can increase over time, particularly if a property is located in an area that is experiencing economic growth or a shortage of available housing. This can result in substantial capital gains when the property is sold.

- Rental income: Rent from tenants can provide a steady stream of income for real estate investors, which can be used to cover expenses related to the property or reinvested to generate additional returns.

- Tax benefits: Real estate investors in India may be able to take advantage of tax deductions for expenses related to their properties, such as mortgage interest and property taxes, which can increase their overall returns.

By carefully evaluating potential real estate investments and managing their properties effectively, investors in India can potentially achieve strong financial returns and build wealth over the long term.

- sdgsags

- kfhaskghakshgkjsdhg

- sdgjhsakjdghksad

- sdgksahkdghskdag